Drake Software can handle thousands of tax returns, making it ideal for both small and large firms. Its scalable features and multi-user capabilities boost productivity during peak seasons.

This article explores this question in depth, covering software capabilities, user experience, system requirements, scalability, and more.

Understanding Drake Software:

Overview of Drake Software:

Founded in 1977, Drake Software has established itself as a leader in tax preparation solutions over four decades. Its mission is to provide innovative software that meets the diverse needs of tax professionals, ensuring accuracy and efficiency in tax preparation. The software features an intuitive interface, extensive reporting tools, and efficient data management, making it suitable for both individual preparers and larger firms. Drake Software continuously evolves to incorporate user feedback and adapt to changing tax laws, ensuring that it remains relevant and reliable.

One of the key strengths of Drake Software is its commitment to customer service and user satisfaction. They offer a range of support options, including live assistance and extensive online resources. This focus on support has garnered a loyal customer base, with many users praising the software for its ease of use and functionality. With a robust set of features tailored for various tax scenarios, Drake Software is an indispensable tool for tax professionals.

Key Features:

Comprehensive Forms:

Drake Software supports all federal and state forms, including complex returns for corporations, partnerships, and nonprofits. This versatility allows tax professionals to manage a wide array of client situations efficiently, simplifying the preparation process and enhancing client satisfaction. The software’s ability to accommodate diverse forms ensures that users can tackle even the most intricate tax scenarios without hassle.

Additionally, the inclusion of forms for various states aids in compliance and keeps the software relevant across different jurisdictions, ensuring users are always equipped with the latest information. The continuous updates to forms reflect changes in tax law, helping preparers stay compliant effortlessly. As a result, tax professionals can focus on providing high-quality service instead of worrying about missing forms or outdated regulations.

Also Read: What Softwares Are Used In Data Entry Texas – Exploring Popular Tools!

Multi-User Access:

The software enables simultaneous access for multiple users, making it ideal for busy tax offices. This feature fosters collaboration among tax preparers, allowing them to share workloads and insights, significantly increasing productivity during peak seasons. As team members can work on different returns concurrently, the overall turnaround time for processing increases, benefiting clients.

Furthermore, this multi-user capability includes user permissions, ensuring that sensitive information is only accessible to authorized personnel. Such security measures not only protect client data but also enhance trust in the tax preparation process. The ability to track user activity also adds an extra layer of accountability, allowing firms to maintain a high standard of service.

E-Filing:

Drake Software’s integrated electronic filing options simplify the submission process, allowing users to file returns directly from the platform. This capability not only saves time but also reduces the chances of errors associated with manual submissions. With secure e-filing features, users can ensure their clients’ sensitive information is transmitted safely, enhancing overall trust. The software also provides instant confirmation of submissions, giving tax professionals peace of mind that their filings have been successfully received.

Additionally, e-filing significantly shortens the turnaround time for clients, enabling quicker refunds and improving client satisfaction. The streamlined process makes it easier for firms to manage large volumes of returns without the administrative burden of paper filing.

Client Tools:

Built-in communication tools facilitate secure document sharing and client interactions, improving relationships and ensuring that all necessary information is collected promptly. Features like client portals enhance transparency and allow clients to upload documents directly, which enhances the overall client experience and fosters trust between tax professionals and their clients.

Furthermore, automated reminders for clients about document submissions and deadlines help keep everyone on track, reducing last-minute scrambles. These tools not only make interactions more efficient but also allow for better tracking of client requests and queries. The result is a more organized and responsive approach to client management, which can lead to higher client retention rates. Effective communication tools ultimately strengthen the professional relationship between tax preparers and clients.

Document Management:

Robust capabilities for attaching and organizing files streamline the documentation process. Tax preparers can maintain all relevant client documents in one place for easy access and reference, reducing the time spent searching for files. This organized approach minimizes the risk of missing critical documents, ensuring that all necessary information is readily available.

Additionally, the software allows for tagging and categorizing documents, making retrieval even more straightforward.

Reporting Features:

Advanced reporting tools allow users to generate a wide variety of reports for analysis and review. This functionality helps firms track performance metrics, manage workflows, and improve operational efficiency. By leveraging these reports, tax professionals can make data-driven decisions that enhance their practices and overall client service. The customizable nature of these reports enables firms to focus on specific KPIs relevant to their operations, providing insights into areas for improvement.

Additionally, visual dashboards can display real-time data, making it easier for managers to monitor team performance at a glance. This analytical capability fosters a culture of accountability and continuous improvement within the firm, ensuring that all staff members are aligned with the firm’s goals.

System Requirements for Optimal Performance:

Hardware Specifications:

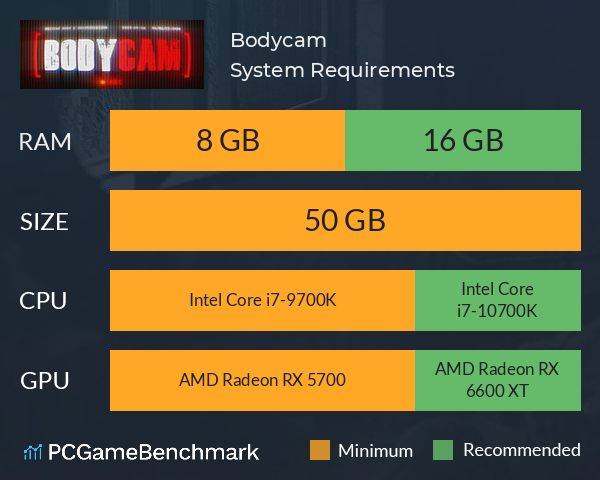

To maximize the performance of Drake Software, certain hardware specifications should be met. This ensures the software can efficiently handle a large volume of tax returns. Adequate hardware is critical for seamless operation, especially during peak filing seasons when demand is at its highest.

In addition, using modern hardware can enhance the overall user experience, leading to faster processing times and reduced frustration. Firms should regularly assess their hardware capabilities to ensure they can adapt to changing demands and software updates.

Processor:

A multi-core processor is recommended to ensure smooth operation, especially when processing multiple returns simultaneously. A powerful CPU can significantly reduce processing time, which is essential during the busy tax season when every minute counts. Selecting processors with higher clock speeds can further enhance performance, allowing tax professionals to navigate the software with ease. Firms should consider investing in processors with advanced technologies like hyper-threading for optimal performance.

Also Read: Is Core Software Technologies Inc – An In-Depth Analysis!

RAM:

A minimum of 8 GB of RAM is ideal; however, 16 GB or more is advisable for firms that handle many returns. More RAM allows for better multitasking capabilities, reducing lag and improving overall performance, which is crucial when working on complex or high-volume tasks. Additionally, having more memory enables the software to handle large datasets efficiently, enhancing processing speed during critical times.

Storage:

SSD drives are recommended for faster loading times and better performance when managing large data files. Solid-state drives significantly enhance read and write speeds, which can improve the overall user experience and efficiency during peak periods. Unlike traditional hard drives, SSDs are less prone to mechanical failure, providing added reliability for sensitive tax data. Firms should also consider implementing additional storage solutions, such as cloud storage, to ensure that data is accessible from various locations.

Network Requirements:

For firms using multi-user setups, a reliable network with adequate bandwidth is crucial to ensure seamless communication between workstations. Slow networks can hinder productivity, especially during peak times when many users are accessing the software simultaneously. Regular network maintenance and upgrades can help prevent bottlenecks and ensure consistent performance. Firms should also evaluate their network infrastructure to accommodate future growth, including additional users and increased data traffic.

Backup Solutions:

Implementing robust data backup solutions is essential to protect sensitive tax data from loss or corruption. Regular backups ensure that firms can recover quickly in case of hardware failure or other issues, minimizing downtime and potential data loss. Cloud-based backup solutions provide an added layer of security, allowing for off-site storage of critical data. Additionally, automated backup schedules can streamline the process, ensuring that backups occur consistently without manual intervention.

Operating System Compatibility:

Drake Software is primarily compatible with Windows operating systems, ensuring usability on most modern PCs. Keeping the system updated helps avoid compatibility issues, allowing users to focus on their work without technical interruptions. Firms should also monitor updates to Windows that may affect software performance, ensuring that all systems remain compatible. Regular system checks can help identify potential issues before they disrupt operations. By maintaining compatibility, tax professionals can ensure uninterrupted access to essential tools and features. This proactive approach contributes to a smoother tax preparation process and enhances overall efficiency.

Windows Versions:

Drake Software is compatible with Windows 10 and later versions, making it essential for users to keep their operating systems up to date. This compatibility not only enhances performance but also helps avoid potential issues during critical filing periods. Users should be aware of the latest Windows updates and security patches to protect their systems from vulnerabilities.

Network Configuration:

Proper network setup is crucial for multi-user environments, allowing seamless access to shared resources and data. A well-configured network reduces downtime and enhances overall efficiency, particularly in busy tax offices where quick access to information is essential. Conducting periodic network audits can help identify potential weaknesses and improve performance.

Additionally, investing in high-quality networking equipment can significantly boost data transfer speeds and reliability. Staff training on network usage and security practices can further enhance the effectiveness of the setup. Overall, an optimized network configuration supports smoother operations and promotes collaboration among team members.

Scalability: How Many Tax Returns Can It Handle?

Single-User vs. Multi-User Environment:

The capacity for handling tax returns varies based on the environment. In a single-user setup, a preparer can typically process dozens of returns daily, depending on each return’s complexity and the user’s experience level. Experienced preparers often find ways to streamline their workflow, allowing them to handle more returns effectively. Single-user systems may be limited by the time it takes to gather documents and complete complex returns.

Multi-User:

In a multi-user setup, the workload can be distributed among team members, allowing firms to manage hundreds or even thousands of returns during peak seasons. This collaborative approach enhances productivity and fosters a supportive team environment where staff can assist each other. Team members can specialize in specific areas, further increasing efficiency as they can process returns more quickly.

Also Read: What Software Does Joe Rogan Use For Subtitles – A Deep Dive into Subtitling Technology!

Yearly Capacity Estimates:

While specific numbers vary, general estimates can provide guidance on return capacity across different firm sizes. Small firms, consisting of just a few tax professionals, might process anywhere from 100 to 500 returns in a season. Their efficiency largely depends on the firm’s operational practices and the staff’s experience.

Medium-sized firms can easily handle between 1,000 to 5,000 returns with proper resource allocation and strategic planning, often utilizing their staff effectively to increase output.

Large firms and tax preparation chains may process 10,000 returns or more during the peak tax season. These firms often implement advanced technology and streamlined processes to manage high volumes efficiently, ensuring that client needs are met promptly.

Efficiency and Workflow Optimization:

User Interface and Navigation:

Drake Software’s user-friendly interface enhances productivity through its intuitive design and streamlined navigation. Features such as customizable dashboards allow users to prioritize tasks effectively, tailoring their workflow to meet individual or team needs. A well-organized workspace can help preparers focus on high-priority clients and tasks, improving overall service delivery.

Additionally, training staff on the software’s layout and shortcuts can further enhance efficiency, enabling team members to maximize their use of the interface. A positive user experience fosters greater job satisfaction and encourages continued use of the software for tax preparation.

Intuitive Design:

The software’s intuitive design simplifies complex processes, making it easier for tax preparers to navigate various functionalities. A clean layout minimizes distractions and allows users to focus on critical tasks, promoting efficiency during busy periods.

Additionally, context-sensitive help features provide quick guidance when needed, reducing frustration and downtime.

Quick Access:

The software offers easy navigation to forms and documents, which reduces the time spent searching for information. Features like search functionalities and shortcuts help users quickly locate the materials they need, enhancing overall efficiency. This ease of access is especially beneficial during busy periods when every second counts, allowing tax preparers to focus on completing returns rather than hunting for documents.

Automation Features:

Automation is key to increasing return capacity and enhancing workflow efficiency. Drake Software allows for quick data entry by enabling users to import data from various sources, significantly cutting down on manual entry. This feature streamlines the data collection process and reduces the risk of errors, allowing preparers to focus on higher-value tasks. Batch processing capabilities enable users to handle multiple returns simultaneously, particularly beneficial during peak filing seasons.

Data Importing:

Drake Software’s data importing features allow users to quickly transfer information from different sources, further speeding up the preparation process. This capability helps reduce data entry errors, enhancing accuracy and reliability. Streamlining data entry minimizes the time spent on administrative tasks, allowing tax professionals to concentrate on client interactions and strategic planning. Integration with accounting software can simplify this data transfer, providing a comprehensive view of clients’ financial situations.

Batch Processing:

Users can process multiple returns simultaneously, which is particularly beneficial during peak filing seasons when demand is highest. This capability allows firms to handle larger volumes of returns without sacrificing accuracy or quality. By implementing batch processing, tax offices can significantly increase throughput, allowing for timely completion of client returns.

Integration with Other Tools:

Drake Software integrates with various tools, enhancing efficiency and expanding capabilities for tax professionals.

Seamless integration with popular accounting software allows for easy data transfers, reducing redundancy and the potential for errors. By connecting Drake Software with other tools used in the tax preparation process, firms can create a more cohesive workflow that streamlines operations. Integration with financial planning software can also provide a holistic view of clients’ financial situations, enabling preparers to offer more tailored advice.

Client Management:

Linking with client management systems streamlines communication and enhances client service, enabling firms to maintain better relationships with their clients. Efficient client management systems facilitate timely communication, appointment scheduling, and document sharing, contributing to a more organized tax preparation process. Integrating these tools allows tax preparers to manage client expectations more effectively, ensuring that all necessary information is collected promptly.

Also Read: What Software Does Wyze Plug Work With – Exploring IFTTT, Alexa, And More!

Support and Training Resources:

Technical Support:

Drake Software offers a variety of support options to assist users effectively throughout the tax season. Access to live support via chat and phone provides timely help during busy periods when immediate solutions are crucial. This quick access to support can make a significant difference for tax professionals facing challenging situations.

Additionally, a comprehensive knowledge base and user forums provide additional assistance, allowing users to find solutions to typical questions independently. This dual approach to support ensures that tax preparers have the resources they need to succeed, enhancing overall confidence in using the software.

Live Support:

Users can benefit from real-time assistance from knowledgeable staff, providing crucial help during peak filing seasons. This direct access to expertise can help firms resolve issues quickly, minimizing downtime and ensuring compliance with deadlines.

Furthermore, having a responsive support team available fosters a sense of partnership between Drake Software and its users, promoting loyalty and trust. By ensuring that users feel supported, Drake Software enhances the overall user experience, allowing tax preparers to focus on their work rather than technical issues. This support infrastructure is vital for maintaining high levels of productivity.

Online Resources:

A comprehensive knowledge base and user forums provide additional avenues for support, allowing users to find solutions to common questions and troubleshoot issues independently. These resources empower tax professionals to seek answers and gain insights from fellow users, fostering a sense of community. Online tutorials and guides can also help users navigate new features and improve their overall proficiency with the software. The availability of these resources is essential for maintaining user satisfaction and ensuring long-term success.

Training Programs:

Drake Software provides various training resources to maximize users’ capabilities. Regular webinars cover new features and best practices, helping users stay informed and engaged. These educational opportunities ensure that tax professionals are well-equipped to adapt to changes and maximize their use of the software.

Additionally, detailed manuals and user guides support users in navigating complex functionalities, providing step-by-step instructions for tackling challenging tasks.

Community Engagement:

Drake Software fosters a supportive user community that encourages collaboration and knowledge-sharing among tax professionals.

Participation in user forums allows professionals to connect and share insights, creating a rich resource for problem-solving and best practices. Engaging with peers can help tax preparers discover new techniques, software features, and industry trends. This community aspect enhances the overall user experience, as professionals can learn from each other’s successes and challenges.

Additionally, the exchange of ideas can lead to innovative solutions and improvements in operational practices. A strong user community contributes to a more connected and informed network of tax professionals.

Feedback Mechanisms:

Users can provide input directly to Drake Software, helping the company improve its offerings based on user needs and experiences. This feedback loop encourages continuous enhancement of the software and demonstrates Drake Software’s commitment to listening to its users. Regular surveys and focus groups can further solicit user opinions on new features, ensuring that development aligns with the needs of the market.

User Experiences and Testimonials:

Positive Feedback:

Many users commend Drake Software for its efficiency and effectiveness in managing tax preparation processes. Testimonials often highlight the software’s ease of use, which allows quick onboarding for new users and minimizes disruptions. This positive user experience is crucial for maintaining productivity, especially during peak tax seasons when time is of the essence.

Additionally, users frequently praise the quality of support they receive, noting that responsive customer service enhances their overall experience with the software. The consistent positive feedback reflects the software’s ability to meet the evolving needs of tax professionals effectively.

Ease of Use:

The intuitive interface and well-designed features contribute to a smoother onboarding experience for new users, allowing firms to adapt rapidly without significant training time. A user-friendly design can enhance productivity and encourage team members to utilize the software’s full range of functionalities.

Additionally, simplifying complex processes helps demystify tax preparation, making it accessible even for less experienced staff. This focus on ease of use ultimately leads to better outcomes for both the firm and its clients, as efficient software can translate to faster processing and improved service quality.

Also Read: How To Update Amd Software Adrenalin Edition G14 – G14 AMD Software Update Made Easy!

Support Quality:

Responsive customer service is frequently praised, with users appreciating the expertise and availability of support staff. Good customer service can enhance user experience significantly, especially during the high-pressure tax season. Many users report quick response times and effective solutions, making them feel valued and supported. Furthermore, well-trained support staff can provide valuable insights and tips, helping users maximize the software’s capabilities. This level of support not only boosts user confidence but also contributes to long-term satisfaction with the product.

Challenges Faced:

While feedback is generally positive, some challenges exist that users commonly mention. New users may find some advanced features daunting initially, though comprehensive training resources can alleviate this issue. Providing ongoing education and support helps ensure that all team members can effectively utilize the software’s full potential.

Additionally, some users express concerns about the initial investment required for the software, especially smaller firms. Balancing the cost against the software’s efficiency and long-term benefits is crucial for firms making this decision. By addressing these challenges proactively, Drake Software can enhance user satisfaction and retention.

Cost Considerations:

Pricing Structure:

Understanding the costs associated with Drake Software is crucial for tax firms considering an investment in the platform. Initial costs can be significant, making it essential for smaller firms to weigh the benefits against the expense.

However, many users find that the features and efficiencies gained often justify the higher upfront investment. A detailed analysis of expected return on investment (ROI) can help firms better understand the potential value derived from using the software.

Initial Costs:

Higher upfront investments can be a barrier for small firms, but the features and benefits often justify the expense. Many users report that the software’s efficiency ultimately leads to increased revenue, as they can take on more clients without significantly raising overhead costs. It’s essential for firms to consider not only the immediate costs but also the long-term gains that result from improved productivity and client satisfaction.

Ongoing Fees:

Annual maintenance and support fees add to total ownership costs, so firms should consider these when budgeting for the software. Understanding the ongoing fees associated with updates and support helps firms prepare financially for their software investment. These fees often contribute to enhanced features and continued improvements, ensuring the software remains effective and relevant. Firms should also evaluate the value of ongoing support in relation to the potential challenges of operating without assistance. By carefully considering ongoing costs, firms can develop a sustainable budget that supports their long-term goals.

Return on Investment:

Despite costs, many find the investment worthwhile, especially when considering the potential for increased productivity. Faster processing times allow firms to take on more clients, leading to higher profitability. Efficient software can translate to more billable hours, providing a tangible return on investment for tax practices.

Additionally, the improved client experiences often result in repeat business and referrals, further enhancing revenue streams. When firms evaluate their ROI, they should consider both direct financial benefits and the long-term impact on client relationships and operational efficiency.

Future-Proofing Your Practice:

Adapting to Changing Regulations:

As tax laws evolve, Drake Software keeps pace with regular updates to ensure compliance with the latest tax laws and regulations. This adaptability is essential for maintaining credibility and trust with clients, as tax professionals need to provide accurate and timely advice. Regular updates also help firms avoid costly penalties associated with non-compliance.

Regular Updates:

Continuous updates ensure compliance with the latest tax laws and regulations, allowing tax professionals to focus on their work rather than worrying about compliance issues. These updates help firms maintain their reputation and build trust with clients, who rely on their preparers for accurate information.

Also Read: Software Updates Error Oracle Id 3104046 – Quick Fixes!

Educational Resources:

Training on new regulations is provided to help tax professionals stay informed, ensuring they can offer accurate advice to clients. These educational resources can come in the form of webinars, workshops, or comprehensive guides detailing recent changes. Ensuring that all staff members are well-versed in the latest regulations enhances overall firm efficiency and client service. Furthermore, access to educational materials fosters a culture of continuous learning, encouraging tax preparers to remain current in their field.

Planning for Growth:

Drake Software is designed to accommodate growth, allowing firms to start with basic packages and add features as needed. This scalability enables firms to customize their software to match their growth trajectory, ensuring they only pay for what they need. As tax practices expand, they can easily integrate additional modules to enhance their capabilities without significant disruptions.

Future Enhancements:

Ongoing improvements align with trends in tax preparation, ensuring that users have access to the latest tools and features. By staying ahead of industry trends, Drake Software helps tax professionals remain competitive and responsive to client needs. Regular feedback from users plays a crucial role in shaping future enhancements, ensuring that the software evolves in line with practical requirements.

Drake Software Multiple Computers:

Drake Software is a popular tax preparation software used by professionals to streamline the filing process. It offers the flexibility to be installed on multiple computers, allowing users to manage their workload efficiently across various devices. This feature is especially useful for tax offices with several employees, enabling seamless collaboration. Users can access their data from different computers, ensuring that work is not disrupted when switching devices.

Additionally, Drake Software provides cloud integration, further enhancing its accessibility and ease of use across multiple workstations.

FAQ’s

What is the typical return capacity for Drake Software?

Drake Software can handle thousands of tax returns, suitable for firms of all sizes.

Can multiple users access Drake Software simultaneously?

Yes, Drake Software supports multi-user access, allowing several tax professionals to work on returns at the same time.

How does Drake Software enhance productivity during peak tax season?

Its scalable features and automation tools streamline processes, enabling faster handling of returns.

Is there a limit to the number of returns I can process?

While there’s no hard limit, capacity largely depends on your hardware and network setup.

What types of returns can Drake Software manage?

It supports a wide range of federal and state forms, including complex returns for corporations and partnerships.

Does Drake Software offer cloud-based storage?

Yes, Drake Software provides cloud integration, allowing users to store and access their data securely from anywhere.

How often is Drake Software updated?

Drake Software is regularly updated to comply with new tax laws and ensure accuracy in returns.

Can Drake Software import data from other tax programs?

Yes, Drake Software offers import features that allow data to be transferred from other tax programs for smoother transitions.

Conclusion

Drake Software is an effective tool for tax professionals, capable of managing a high volume of tax returns efficiently. Its features, including multi-user access and automation, enhance productivity and client satisfaction. When choosing tax software, consider your firm’s specific needs and growth potential. With its adaptability and strong support, Drake Software is a reliable choice for optimizing tax preparation operations.