Tax preparation software streamlines filing by automating calculations, maximizing deductions, and ensuring accuracy.

In this article, we will explore how tax preparation software can help you prepare and file your taxes by simplifying the entire process, minimizing errors, maximizing deductions, and ensuring that you file your return accurately.

What is Tax Preparation Software?

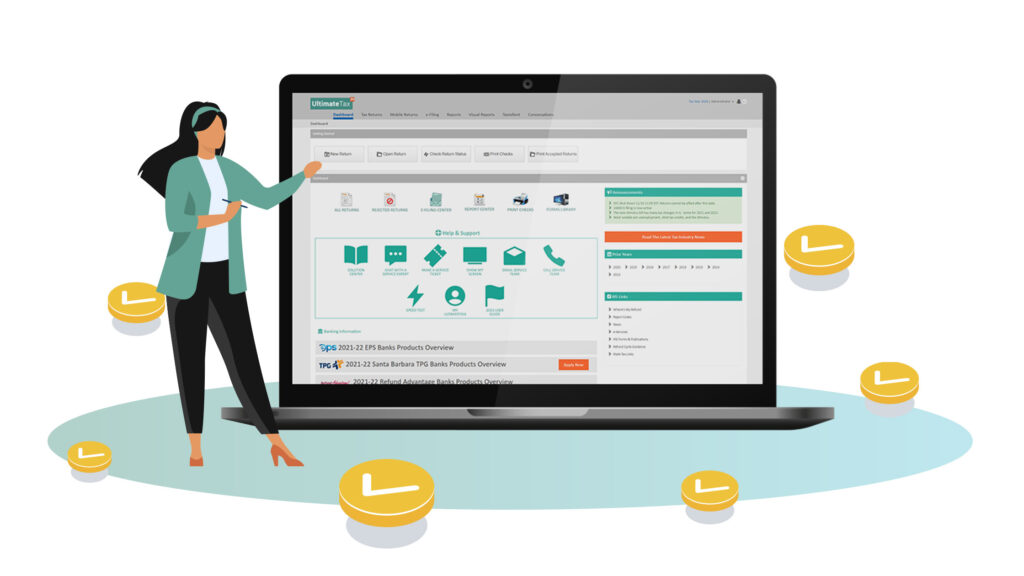

Tax preparation software is an application or online platform designed to assist taxpayers in preparing and filing their income taxes. These programs are equipped with tools that automate the process of entering tax-related information, calculating tax liabilities, and submitting tax returns.

Many of these software solutions are designed for individual tax filers, while others are tailored to small businesses, freelancers, and self-employed individuals who have more complex tax situations. Some popular tax preparation software programs include TurboTax, H&R Block, TaxSlayer, and TaxAct.

How Tax Preparation Software Helps in Preparing Taxes:

Tax preparation software can help prepare and file your taxes by simplifying the process, guiding you through every step, and ensuring that all the necessary information is entered correctly. Here’s a closer look at how these tools can help:

Also Read: What Kind Of Software Is Reflector 4 – A Detailed Guide!

Guided Step-by-Step Process:

Tax preparation software offers a guided step-by-step approach to help users through the filing process. By asking relevant questions about your income, deductions, and filing status, the software tailors your experience and provides you with the forms or worksheets needed for your specific situation.

This structure reduces the chances of missing important details, ensuring that your tax return is complete.

Automated Calculations:

Tax software automatically calculates your tax liability based on the information you input. It handles income from various sources, such as W-2 forms, 1099s, and self-employment income. The software also accounts for deductions, credits, and applies the appropriate tax rates according to your income.

This automation helps you avoid manual errors and saves you time by ensuring the calculations are accurate.

Maximizing Deductions and Credits:

Tax preparation software ensures you don’t miss out on any potential deductions and credits that could reduce your tax liability. It suggests eligible deductions, including those for education, mortgage interest, medical expenses, and charitable donations. The software also helps you choose between itemizing deductions or taking the standard deduction.

By suggesting these tax-saving opportunities, software helps maximize your refund or minimize what you owe.

Ensuring Compliance with Tax Laws:

Tax preparation software is always updated to reflect the latest tax laws and regulations. It integrates new changes in tax law, such as updates to tax brackets, credits, and deductions, ensuring that your filing is always up-to-date and compliant with IRS guidelines.

This minimizes the risk of errors and helps avoid audits.

E-Filing and Direct Deposit for Faster Processing:

Tax software enables you to file your taxes electronically, or e-file, which is a faster, more secure method than paper filing. E-filing allows for quicker processing of your tax return and, if you’re due for a refund, it can be directly deposited into your bank account.

This method often results in faster refunds, sometimes within days.

Additional Benefits of Using Tax Preparation Software:

Tax preparation software offers several additional advantages that enhance the filing experience.

Secure and Protected Data:

Tax preparation software is designed with high-level encryption protocols to protect your sensitive information. Most platforms also offer password protection and two-factor authentication for an added layer of security, ensuring that your personal data is safe throughout the process.

Audit Support:

Many tax software programs offer audit support to help you navigate the complex process in case your return is selected for audit. This support may include guidance, direct access to tax professionals, or in some cases, full audit protection services.

Audit support helps reduce the stress and confusion that can arise from an audit.

Cost-Effective Options:

Many tax preparation software programs offer free versions for simple tax returns, making it accessible to most taxpayers. For more complex situations, paid versions offer enhanced features such as expert tax support, itemized deductions, and access to additional forms. These tools can be a cost-effective alternative to hiring an accountant.

Access to Professional Tax Help:

Some tax software options offer access to tax professionals who can provide personalized assistance if needed. This feature is particularly valuable for those with complex tax situations or who simply want expert guidance while preparing their return.

Professional support can help clarify questions and give confidence in your filing.

FAQ’s

1. Is tax preparation software accurate?

Yes, tax preparation software is designed to be accurate, with automated calculations and built-in error-checking to minimize mistakes and ensure your return is filed correctly.

2. Can I file my taxes for free with tax preparation software?

Many software providers offer free filing for basic tax returns, though more complex returns may require a paid version of the software.

3. Can tax preparation software handle multiple income sources?

Yes, tax software can manage income from various sources, such as W-2s, 1099s, freelance income, and investments, ensuring all information is included in your return.

4. What happens if I make a mistake on my tax return?

Most tax software allows you to easily correct errors before submitting your return to the IRS, minimizing the chances of filing a wrong return.

5. How secure is tax preparation software?

Tax preparation software uses encryption and other security features to protect your personal data, ensuring it remains safe throughout the filing process.

Conclusion

Tax preparation software streamlines filing by automating calculations, maximizing deductions, ensuring compliance, and offering secure e-filing. It reduces errors and helps taxpayers secure the maximum refund. Using tax software simplifies the process and optimizes tax-saving opportunities, making it easier to file accurately and efficiently while minimizing potential issues with tax authorities.

Related Posts

Also Read: What Software Do Financial Advisors Use To Watch Stock Market – A Deep Dive!

Also Read: Why Didnt Visual Languages Replace All Software Devlopment – An In-Depth Analysis!

Also Read: FTDI Software Drivers Downloads – An Expert’s Guide!