Valuing a new software business is essential for both entrepreneurs and investors to determine its worth and potential for growth. With factors like revenue, market demand, and intellectual property influencing the value, it’s important to use the right methods to arrive at an accurate estimation.

“To value a new software business, assess key factors like projected revenue, growth potential, and market demand. Use valuation methods such as discounted cash flow (DCF) and revenue multiples for a more accurate estimate”

In this article, We will discuss “How To Value A New Software Business”

How to Value a New Software Business:

Valuing a new software business can be challenging, especially with many factors influencing its potential for growth and profitability. Whether you’re an entrepreneur looking to sell or an investor seeking to buy, understanding how to assess a software company’s worth is crucial. This guide outlines the key methods and factors to consider when valuing a new software business.

1. Key Factors in Valuing a Software Business:

Several factors play a role in determining the value of a new software business:

- Revenue Growth: A key indicator of a software company’s value is its revenue growth. Investors typically look for businesses that show consistent and increasing revenue over time, reflecting strong market traction and potential.

- Recurring Revenue: The presence of recurring revenue streams, such as subscription models or service agreements, adds to the business’s long-term stability and value. Predictable income helps in estimating future performance more accurately.

- Customer Base: A growing, loyal customer base can increase the value of a software business. Customer retention rates are also crucial to understanding the company’s future earning potential, as they indicate customer satisfaction and product-market fit.

- Market Demand: The size and growth potential of the market the software serves play an important role in its valuation. High demand within a growing market increases the company’s value and potential for scaling.

- Intellectual Property: Proprietary technology, patents, or unique features that set the software apart from competitors can boost a business’s value significantly. Intellectual property can also provide a competitive advantage and barriers to entry for others.

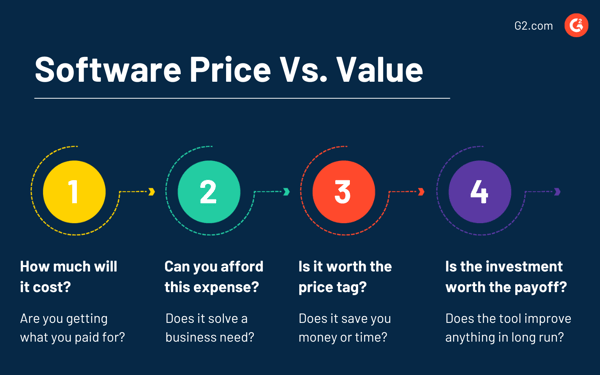

2. Valuation Methods for Software Businesses:

There are several methods used to value new software businesses. The most commonly used ones include:

Also Read: Are Old Animation Softwares Eaiser To Use – A Detailed Comparison!

Discounted Cash Flow (DCF) Method:

The DCF method calculates the present value of future cash flows the business is expected to generate. This method works well for software companies with predictable cash flow and growth rates.

By discounting the future cash flows to their present value, you can estimate the company’s worth based on its earning potential.

Revenue Multiple Method:

This method is popular for software startups, where revenue growth is a more reliable indicator of success than profits, especially in the early stages. The revenue multiple method involves applying a multiple (based on industry standards) to the company’s revenue to determine its value.

For instance, if a company generates $1 million in revenue and the industry multiple is 5x, the valuation would be $5 million.

Comparable Company Analysis (CCA):

This approach compares the new software business with other similar companies that have recently been valued or sold. By analyzing the valuation metrics of comparable businesses, such as their revenue, market size, and customer base, you can estimate the value of your software business relative to its peers.

3. Additional Considerations:

Profitability vs. Growth Potential:

For new software companies, investors often prioritize growth potential over profitability, especially in the early stages. Many software businesses operate at a loss in their initial years as they focus on product development and customer acquisition. Therefore, projecting future growth and profitability is critical to arriving at a realistic valuation.

Risk Factors:

Every new software business comes with risks, including competition, technological advancements, and market changes. When valuing a company, it’s important to consider potential risks and how they could impact future earnings.

Also Read: Are There More High level Embedded Software Engineer Career Paths – Comprehensive Guide!

Intellectual Property (IP) Value:

If the software company holds valuable IP, such as patents, exclusive features, or proprietary algorithms, it can substantially increase the business’s overall worth. IP adds to the uniqueness and defensibility of the business in a competitive market.

4. Tips for Getting an Accurate Valuation:

- Hire a Professional: Getting a professional valuation from an experienced financial advisor or business analyst can help ensure accuracy. Their expertise provides a comprehensive analysis based on industry standards and financial principles.

- Keep Detailed Financial Records: Accurate financial records, including revenue, expenses, and growth metrics, will make the valuation process smoother and more precise. Detailed records help in providing a clear picture of the business’s financial health.

- Consider Long-Term Growth: Investors and buyers are more likely to value a software business higher if it has clear potential for long-term growth and scalability. Demonstrating a well-defined growth strategy can enhance the perceived value of the company.

FAQ’s

1. What are the key factors to consider when valuing a software business?

Key factors include revenue growth, recurring revenue, customer base, market demand, and intellectual property. These elements indicate the company’s stability and future potential.

2. What is the most common method for valuing software businesses?

The most common methods include discounted cash flow (DCF), revenue multiples, and comparable company analysis. Each method provides insights based on revenue, cash flow, or industry benchmarks.

3. How does recurring revenue impact valuation?

Recurring revenue, such as from subscriptions, increases a software company’s value by ensuring consistent and predictable cash flow over time.

4. Why is growth potential more important than profitability for new software businesses:

For early-stage software businesses, growth potential often outweighs profitability as investors

prioritize long-term scalability and market penetration over short-term profits.

5. How can intellectual property affect the value of a software company?

Intellectual property, like patents or proprietary technology, adds uniqueness and defensibility, significantly increasing the company’s overall value in a competitive market.

Conclusion

Valuing a new software business requires assessing key factors like revenue growth, market demand, and intellectual property. Using methods such as discounted cash flow, revenue multiples, and comparable company analysis can provide a clear estimate of the business’s worth. A thorough evaluation ensures informed decisions for both investors and business owners.