Having your bank account and routing numbers ready when using tax preparation software ensures faster refunds, accurate payments, and enhanced security during the tax filing process.

In this article, we’ll explore why it’s essential to have your bank account and routing numbers when using tax software.

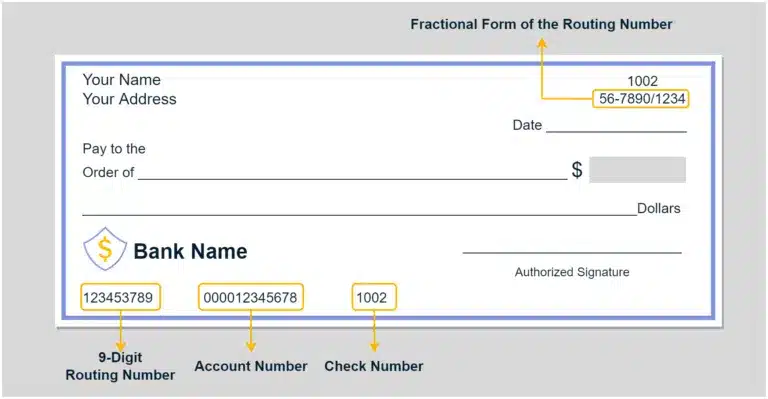

What Are Bank Account and Routing Numbers?

Before diving into the reasons for needing your bank details, it’s important to understand what bank account and routing numbers are:

- Bank Account Number: A unique identifier for your individual bank account. It helps differentiate your account from others at the same bank.

- Routing Number: A nine-digit number that identifies the bank or financial institution where your account is held. This ensures that transfers go to the correct bank.

Both of these numbers play a critical role when filing taxes using tax software, ensuring your refund is processed quickly or payments are made correctly.

Facilitating Direct Deposit of Tax Refunds:

Having your bank account and routing numbers ready allows you to opt for direct deposit of your tax refund, which offers multiple benefits:

Also Read: SEO Software Rapid URL Indexer – A Definitive Guide!

- Faster Refunds: Direct deposit typically ensures your refund reaches your account within 21 days, significantly faster than receiving a paper check.

- Security: Direct deposit reduces the risk of fraud, theft, or loss associated with waiting for a paper check in the mail.

- Convenience: No need to visit the bank—your refund is automatically deposited into your account, providing easy access to your funds.

By entering your bank details into your tax software, you can expedite your refund and avoid the hassles of paper checks.

Ensuring Accurate and Timely Payments:

If you owe taxes, providing your bank account and routing numbers ensures accurate and timely payments to the IRS:

- Seamless Payment Processing: Tax software allows you to make payments directly from your account, ensuring a smooth transfer of funds.

- Avoiding Late Fees: With accurate banking information, you can schedule automatic payments, avoiding penalties for missed or delayed payments.

- Security: Using bank details in tax software means your payments are securely processed, minimizing the risk of errors.

Having your bank information ready helps ensure that you meet your tax obligations without complications.

Minimizing Human Error During Tax Filing:

Tax preparation software is designed to reduce errors, and having your bank account and routing numbers ready can further minimize mistakes:

Also Read: Student Software – Revolutionizing Education and Learning Efficiency!

- Auto-Fill Capabilities: Many software programs auto-fill your bank details from previous filings, saving time and reducing the risk of manual entry errors.

- Error Prevention: Tax software often validates your bank information to ensure that it’s correct before submitting your return, preventing mistakes.

- Faster Filing: With pre-entered and validated bank details, you can file your taxes more quickly and confidently.

This reduces the risk of errors that could delay your refund or cause other issues during the filing process.

Speeding Up the Filing Process:

When you have your bank details on hand, you can speed up the filing process and save time:

- Pre-Filled Forms: Tax software can pre-fill your bank account information from previous filings, allowing you to complete your return quickly.

- Instant Calculations: Having your bank details available helps the software instantly calculate your refund or tax liability.

- Quick Submission: With all necessary information on hand, you can submit your return and payment in no time.

This makes the entire filing process more efficient and helps you avoid unnecessary delays.

Error-Free Bank Information Validation:

Tax software often validates the bank account and routing numbers you input, helping prevent mistakes:

Also Read: Labview Software – Data Acquisition and System Control!

- Automatic Error Detection: Software checks whether the numbers you’ve entered are valid and align with your bank’s codes.

- IRS Cross-Checks: Some programs validate your bank details against IRS databases to ensure accuracy.

- Alerts for Mistakes: If the software detects an error in your bank details, it will prompt you to correct it before filing.

These built-in validations minimize the risk of errors, ensuring your refund or payments are processed without issues.

Ensuring Consistency Across Tax Years:

Once you enter your bank account and routing numbers into tax software, this information remains consistent, making future filings easier:

- Saved Information: Many tax software programs save your bank details for future use, so you don’t need to re-enter them every year.

- Faster Filing in the Future: By saving your bank details, you can file your taxes faster in subsequent years.

- Access to Historical Data: Some programs allow you to access past returns with all your bank details pre-filled, ensuring smooth future filings.

This continuity simplifies the tax filing process in the long run.

Maximizing Refund Opportunities and Tax Benefits:

Providing your bank details can also help you maximize refunds and tax benefits:

Also Read: Dentrix Software – Everything You Need to Know!

- Faster Access to Credits: Some tax credits, such as the Earned Income Tax Credit (EITC), can be processed more quickly if you choose direct deposit.

- Refund Splitting: If desired, you can split your refund between multiple accounts, which can help you manage your finances more effectively.

- Maximizing Refund Timing: Having your bank details ensures you receive any refund-related benefits quickly and without delays.

With the correct banking information, you can ensure your refund is processed promptly and that you take advantage of any available tax benefits.

Enhancing Financial Security and Reducing Fraud Risks:

When you enter your bank account and routing numbers into tax preparation software, you are improving security:

- Secure Transactions: Most tax software uses encryption to protect your banking data during submission.

- Preventing Fraud: Having your bank details validated can prevent tax fraud, ensuring your refund isn’t rerouted to a fraudster’s account.

- Two-Factor Authentication: Many programs employ security measures like two-factor authentication to protect sensitive information.

By providing accurate bank details, you are helping ensure that your data and funds are secure throughout the filing process.

FAQ’s

1. Why do I need to provide my bank account and routing numbers when filing taxes?

To receive your tax refund via direct deposit, which is faster and more secure than receiving a paper check.

2. Can I file my taxes without a bank account?

Yes, you can, but you’ll likely receive your refund via a paper check, which can take longer.

3. What happens if I enter the wrong bank account or routing number?

If the details are incorrect, it could delay your refund or send it to the wrong account. Tax software usually validates this information to help avoid errors.

4. Is it safe to enter my bank account details into tax software?

Yes, reputable tax software uses encryption and secure protocols to protect your banking information.

5. Can I change my bank account details after I’ve already filed?

Once filed, you can’t change your bank details. If there’s an error, you can contact the IRS to address the issue.

Conclusion

Having your bank account and routing numbers ready when using tax preparation software helps speed up the process, enhances security, and ensures accurate refunds and payments. It simplifies the filing process, avoids errors, and provides a smoother tax season overall. By ensuring your banking details are correct, you can minimize delays and maximize the benefits of filing your taxes efficiently.

Related Posts

Also Read: Best Tax Software – A Comprehensive Guide!

Also Read: OBS Studio Download – The Complete Resource!